Monday, June 28, 2010

Correlation Between S&P500 and 10-yr Tsy: An Ominous Sign?

Factor Analysis of Hedge Funds: The Case of Och-Ziff

Here’s a quick multi-factor analysis of Och-Ziff Overseas II, more precisely of its last 77 monthly NAVs (including May 2010). There are a few interesting take-aways:

- 99% of OZ’s performance, per the Adjusted R-Squared, can be explained by this factor model, which is obviously almost perfect.

- The factors explaining the performance in this model are the S&P 500, the MSCI World index, the Leveraged Loan index, and the Credit Suisse High Yield Bond index.

- The sign of the terms for the S&P 500 and the Leveraged Loan index is negative (with high t-stats. Actually, the t-stats leave no doubt on the significance of the parameters, since they’re all, in absolute terms, above 6.) That is, a significant part of OZ’s returns comes from being SHORT the S&P500, or rather, more probably, by hedging HY bond and global equity positions with shorts/puts on the S&P500.

- Whatever the best explanation for the negative S&P coefficient, this factor analysis indicates that OZ certainly is not a simple levered play on any of these markets.

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.994780933

R Square 0.989589104

Adjusted R Square 0.989018644

Standard Error 0.019640803

Observations 78

ANOVA

df SS MS F Significance F

Regression 4 2.676752148 0.669188037 1734.721144 1.61407E-71

Residual 73 0.028160565 0.000385761

Total 77 2.704912713

Coefficients Std Error t Stat P-value

Intercept 0.918831919 0.028415423 32.33567607 5.221E-45

MSCI World 0.000880636 9.31751E-05 9.451410452 2.66496E-14

Lev Loan index -0.007563448 0.00059902 -12.6263688 4.89766E-20

CS HY Index 0.001589215 .2593E-05 37.31167533 2.72932E-49

S&P 500 -0.000828656 0.000126406 -6.55550518 6.87152E-09

M&A Feast for Hedge and Private Equity Funds

| Target | Acquirer | Deal Size (M) | Announced Premium in % | Payment Type | Current Premium in % | Expected Completion Date | |

| XTO ENERGY INC | EXXON MOBIL CORP | 41366.82 | 25.94 | Stk | 0.05 | 06/28/10 | |

| QWEST COMMUNICATIONS INTL | CENTURYLINK INC | 22161.55 | 12.49 | Stk | 6.84 | 06/30/11 | |

| SMITH INTERNATIONAL INC | SCHLUMBERGER LTD | 12342.48 | 42.18 | Stk | 2.22 | 12/31/10 | |

| ALCON INC | NOVARTIS AG-REG | 10567.14 | -5.99 | Stk | -9.31 | ||

| ALLEGHENY ENERGY INC | FIRSTENERGY CORP | 9216.11 | 36.15 | Stk | 14.17 | 04/30/11 | |

| MILLIPORE CORP | MERCK KGAA | 6805.77 | 42.48 | Cash | 0.38 | 12/31/10 | |

| AIRGAS INC | AIR PRODUCTS & CHEMICALS INC | 6641.21 | 27.13 | Cash | -3.83 | 08/13/10 | |

| SYBASE INC | SAP AG | 5322.65 | 47.75 | Cash | 0.73 | 07/01/10 | |

| TALECRIS BIOTHERAPEUTICS | GRIFOLS SA | 3890.94 | 53.45 | C&S | 22.9 | 12/31/10 | |

| MARINER ENERGY INC | APACHE CORP | 3801.5 | 60.85 | C&S | 4.38 | 09/30/10 | |

| CONTINENTAL AIRLINES-CLASS B | UAL CORP | 3185.64 | 1.61 | Stk | -0.19 | 12/31/10 | |

| PSYCHIATRIC SOLUTIONS INC | UNIVERSAL HEALTH SERVICES-B | 3114.41 | 6.1 | Cash | 3.04 | 12/31/10 | |

| INTERACTIVE DATA CORP | Multiple | 2996.24 | 1.81 | Cash | 1.62 | 09/30/10 | |

| BUCKEYE GP HOLDINGS LP | BUCKEYE PARTNERS LP | 2720.89 | 30.42 | Stk | 6.96 | 12/31/10 | |

| EV3 INC | COVIDIEN PLC | 2489.97 | 19.71 | Cash | 0.67 | 07/31/10 | |

| MIRANT CORP | RRI ENERGY INC | 2273.7 | -1.01 | Stk | 1.52 | 12/31/10 | |

| CASEY'S GENERAL STORES INC | ALIMENTATION COUCHE-TARD -B | 1862.09 | 16.34 | Cash | 1.15 | 07/09/10 | |

| CYBERSOURCE CORP | VISA INC-CLASS A SHARES | 1796.58 | 40.38 | Cash | 2.08 | 12/31/10 | |

| GERDAU AMERISTEEL CORP | GERDAU SA-PREF | 1607.07 | 47.5 | Cash | 0.58 | ||

| ARENA RESOURCES INC | SANDRIDGE ENERGY INC | 1563.56 | 25.82 | C&S | 1.74 | 09/30/10 | |

| DYNCORP INTERNATIONAL INC-A | Private (Cerberus) | 1472.82 | 50.21 | Cash | 0.98 | 12/31/10 | |

| ECLIPSYS CORP | ALLSCRIPTS-MISYS HEALTHCARE | 1242.63 | 20.05 | Stk | 7.33 | 12/31/10 | |

| RCN CORP | Private | 1192.29 | 38.33 | Cash | 1.08 | 12/31/10 | |

| AMERICAN ITALIAN PASTA CO-A | RALCORP HOLDINGS INC | 1171.62 | 36.22 | Cash | 0.36 | 07/22/10 | |

| GLG PARTNERS INC | MAN GROUP PLC | 1130.59 | 42.09 | Cash | 3.69 | 09/30/10 | |

| INVENTIV HEALTH INC | THOMAS H. LEE PARTNERS LP | 1091.03 | 9.85 | Cash | 2.04 | 09/30/10 | |

| STANLEY INC | CGI GROUP INC - CL A | 1054.64 | 20.07 | Cash | 0.54 | 07/09/10 | |

| CKE RESTAURANTS INC | APOLLO GLOBAL MANAGEMENT LLC | 1009.5 | 5.91 | Cash | 0.32 | ||

| LIONS GATE ENTERTAINMENT COR | ICAHN ENTERPRISES LP | 1001.42 | 32.6 | Cash | -0.92 | 06/30/10 |

Tuesday, June 15, 2010

Deep Discounts on Secondary Market for Hedge Fund Investments

Benchmarking Volatility Strategies

Despite the sudden spike in realized volatility, the S&P Vol Arb index still outperforms the equity market (S&P500) since inception in 1990. The graph below plots the total return version of the Vol Arb index (SPARBVN, in amber) calculated on a total return (funded) basis, versus the total return on the S&P 500 (with dividend reinvestment) shown in white. Indeed, the Vol Arb index shows that a rule-based variance swap strategy, despite the drop in the Fall of 08, is still far ahead of the return on the S&P500. Moreover, its volatility is clearly much lower.

Monday, June 14, 2010

Owl Creek Overseas Correlation With Equity Markets

On the surface, it looks true: correlation with the S&P500 index, since inception, is 11%, and the linear regression doesn’t even have good explanatory power (t-stat is weak, only 1):

But it you look closely at the above graph, you’ll notice two areas clustered around two diagonals, one in the top left corner and the other around one of the main diagonals. The graph below makes that more clear:

In fact, correlation with the S&P500 has been atrociously high over two distinct periods: from inception to end of December 2007, when correlation was 97%; and from the end of October 08 to present, when correlation has been 92%. Only 10 months of returns are spread out in a random/uncorrelated fashion between the two periods. This shift in correlation regime, to use technical words, created the “Z-shaped” plot of the first graph, which of course fools linear regression and entails an artificially low correlation for the whole period.

Tuesday, May 4, 2010

Thursday, March 18, 2010

Largest U.S. Hedge Funds, by Assets

Name AUM according to BAML AUM according to AR+A

Bridgewater 43.6 43.6

Paulson & Co. 15 (incorrect!) 32 (definitely correct)

King Street 18.5 19

D.E. Shaw & Co. 16.1 23

Och-Ziff 14.4 23

Baupost Not mentioned 21.8

Angelo Gordon Not mentioned 20.8

Farallon Not mentioned 20.7

SAC Capital Advisors 14 12

Highbridge 12.4 17.9

Citadel Investment Group 10.7 12

Renaissance 9.2 15

Tudor 9.2 10

TPG-Axon Capital 8.3 9.6

Soros Fund Management 8.3 27

Viking Global Investors 7.6 11.8

Wednesday, March 17, 2010

Ultra Futures Contract

Tuesday, March 2, 2010

A New T-Bond Futures Contract: the Ultra

A new contract was launched by the CME Group, the Chicago exchange. The so-called Ultra T-Bond futures takes as deliverable bonds with at least 25 years of remaining term to maturity. This opens the door to quite a few trades and asset-liability management ideas, some of them being detailed on the CME web site: www.cmegroup.com/ultra.

BTW, the code for this new contract is "WN" like "US" is the code for the classic T-Bond futures and "TY" for 10-year contracts. For example, WNH0 refers to the March 2010 Ultra futures contract.

Tuesday, February 23, 2010

China and India Piling Up on Gold -- So What?

Railroad Freight

Monday, January 25, 2010

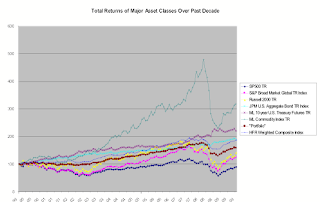

Best Performing Hedge Fund Strategies This Past Decade

(click on chart to enlarge. Source: dataforthoughts)

Palladium and Copper Retraced

Butterfly Retraced Friday

Thursday, January 21, 2010

Butterfly on 1-Month Options on Mid-Term Swaps

Thursday, January 7, 2010

Follow-Up on RYL v. KBH

The Lost Decade of Equities - What About Hedge Funds?

The "classic" portfolio I picked consists of:

- US Large Cap (Total return on the S&P500), with a weight of 30%

- Global Equities (S&P Broad Market Global TR Index), 20%

- U.S. Corporate bonds (JPM U.S. Aggregate Bond TR Index), 20%

- U.S. Government Bonds (Merrill Lynch 10-year U.S. Treasury Futures TR), 20%

- Commodities (Merrill Lynch Commodity Index TR), 10%

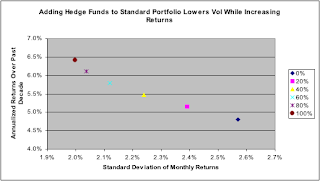

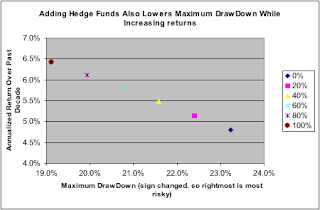

On a non-risk-adjusted basis, the basket of HFs does just a bit better than the classic portfolio. We also note that commodities had a phenomenal run, and that equities of all sorts indeed had a lost decade. Now, if we adjust for risk, we can see that the HF index does considerably better. In the graphs below, we add to the classic portfolio a varying dose of the HF index: 0% corresponds to the pure classic portfolio, and 100% is the HF index alone.

The first graph plots annualized returns against standard deviation of monthly returns:

Surprisingly, the HF index beats the portfolio by about 1 p.p., on average, each year, for a much lower volatility. If we look at Maximum Draw Down as another measure of risk, we get the same result:

In conclusion, despite the turmoil of 2008 and 2009, institutional investors will probably (and should) maintain a healthy allocation to hedge funds.

An Indirect Impact of the Housing Burst on the Economy: Through Workforce Immobility

In a Bloomberg article today: "The ability to relocate for employment, which helped the U.S. recover quickly after previous deep recessions, is the latest victim of the housing bust. About 12.5 percent of Americans moved in the year ended March 2009, the second-lowest ever, estimates Brookings Institution demographer William Frey, after a 60-year record low of 11.9 percent the previous year."

The impact on the economy is not just theoretical. In the same article: "The stagnant workforce may raise the long-term trend rate for unemployment by 1 percentage point and lower economic growth 0.3 percent a year through 2012, said Michael Feroli, an economist in New York for JPMorgan Chase & Co. It has already contributed to keeping the jobless rate as much as 1.5 percentage points higher than would have been suggested by the depth of the recession, Peter Orszag, director of the U.S. Office of Management and Budget, estimated in July."