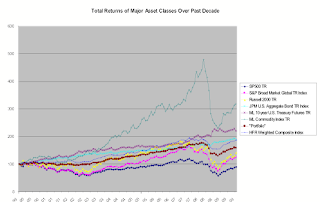

The "classic" portfolio I picked consists of:

- US Large Cap (Total return on the S&P500), with a weight of 30%

- Global Equities (S&P Broad Market Global TR Index), 20%

- U.S. Corporate bonds (JPM U.S. Aggregate Bond TR Index), 20%

- U.S. Government Bonds (Merrill Lynch 10-year U.S. Treasury Futures TR), 20%

- Commodities (Merrill Lynch Commodity Index TR), 10%

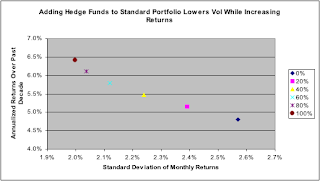

On a non-risk-adjusted basis, the basket of HFs does just a bit better than the classic portfolio. We also note that commodities had a phenomenal run, and that equities of all sorts indeed had a lost decade. Now, if we adjust for risk, we can see that the HF index does considerably better. In the graphs below, we add to the classic portfolio a varying dose of the HF index: 0% corresponds to the pure classic portfolio, and 100% is the HF index alone.

The first graph plots annualized returns against standard deviation of monthly returns:

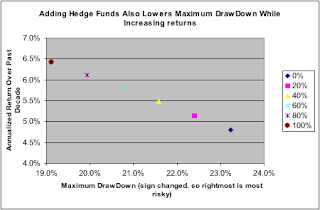

Surprisingly, the HF index beats the portfolio by about 1 p.p., on average, each year, for a much lower volatility. If we look at Maximum Draw Down as another measure of risk, we get the same result:

In conclusion, despite the turmoil of 2008 and 2009, institutional investors will probably (and should) maintain a healthy allocation to hedge funds.

No comments:

Post a Comment