The quick study that follows looks at the past decade (from 1/1/00 to 12/31/09), and compares the total returns of a balanced portfolio of classic asset classes with that of a basket of hedge funds. (I used the HFR Weighted Composite Index as a proxy for a well diversified basket of HFs.)

The "classic" portfolio I picked consists of:

- US Large Cap (Total return on the S&P500), with a weight of 30%

- Global Equities (S&P Broad Market Global TR Index), 20%

- U.S. Corporate bonds (JPM U.S. Aggregate Bond TR Index), 20%

- U.S. Government Bonds (Merrill Lynch 10-year U.S. Treasury Futures TR), 20%

- Commodities (Merrill Lynch Commodity Index TR), 10%

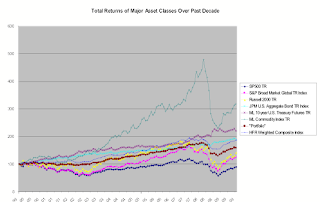

The table below shows the values, normalized to begin the decade at 100, of the different asset classes (indices), together with that of the HF index and that of the classic portfolio described above.

On a non-risk-adjusted basis, the basket of HFs does just a bit better than the classic portfolio. We also note that commodities had a phenomenal run, and that equities of all sorts indeed had a lost decade. Now, if we adjust for risk, we can see that the HF index does considerably better. In the graphs below, we add to the classic portfolio a varying dose of the HF index: 0% corresponds to the pure classic portfolio, and 100% is the HF index alone.

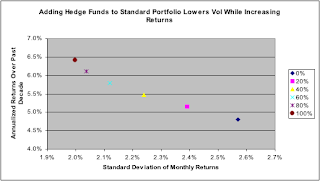

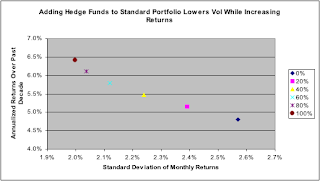

The first graph plots annualized returns against standard deviation of monthly returns:

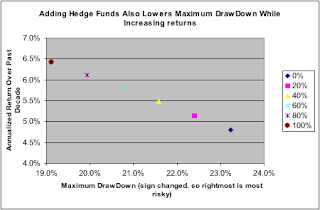

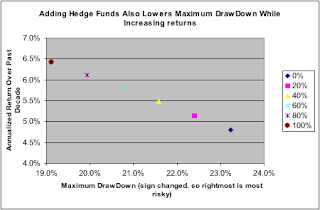

Surprisingly, the HF index beats the portfolio by about 1 p.p., on average, each year, for a much lower volatility. If we look at Maximum Draw Down as another measure of risk, we get the same result:

In conclusion, despite the turmoil of 2008 and 2009, institutional investors will probably (and should) maintain a healthy allocation to hedge funds.